Financial scams in 2025 are more sophisticated than ever, targeting individuals across Europe through digital, social, and investment channels. With the rise of AI-generated content, deepfakes, and fraudulent cryptocurrency platforms, staying informed is essential. This article outlines the most common financial scams, real examples, and practical tips to protect yourself and your family.

The Rise of Modern Financial Scams in Europe

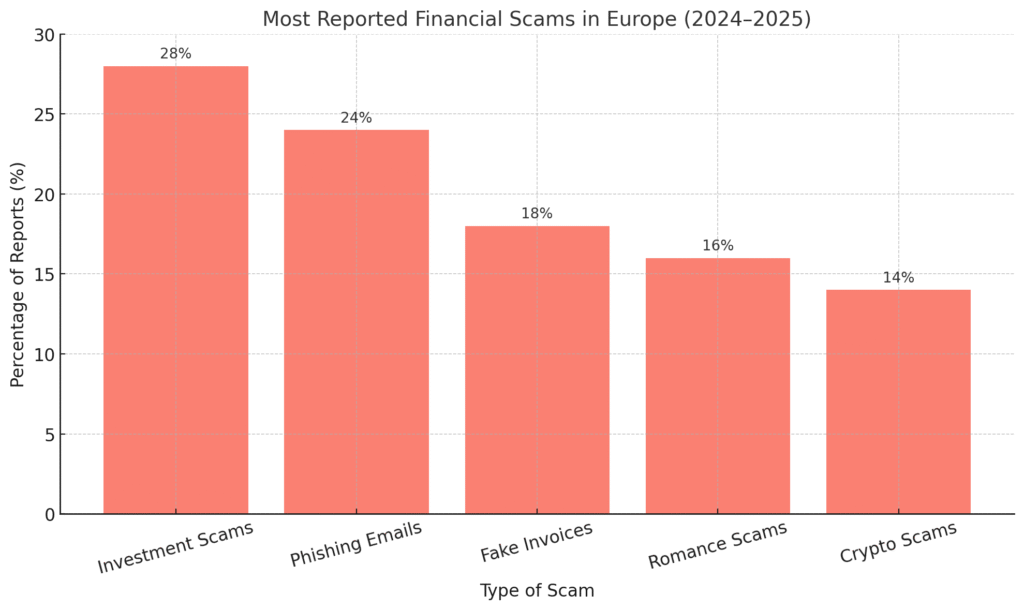

As digital transactions increase, so does scam activity. According to Europol’s 2025 Cybercrime Report, over €5.6 billion was lost to financial fraud across the EU in 2024 alone. The chart below shows the most reported scam types, with investment scams and phishing leading the pack.

Common Types of Scams in 2025:

- AI-Deepfake Scams: Fraudsters impersonate CEOs or relatives using AI voice or video to request money transfers.

- Crypto Investment Scams: Fake crypto platforms offering high returns with no risk.

- Phishing Emails and SMS: Fake bank or tax authority messages leading to credential theft.

- Romance Scams: Emotional manipulation via dating apps asking for financial help.

- Fake Invoices for Businesses: Targeting small businesses with believable but fake payment requests.

Real-World Scam Examples

Deepfake CEO Voice Scam (Germany, March 2025)

A finance officer at a Berlin-based startup transferred €243,000 after receiving what sounded like a voice note from the CEO. It was later revealed to be an AI-generated voice.

Crypto Platform ‘NextCoinX’ (France, January 2025)

Thousands of users invested in this so-called high-yield crypto fund. The platform vanished overnight, leaving no way to recover funds. It mimicked the UI of real licensed platforms, misleading many.

Romance Scam Targeting Retirees (Spain, Ongoing)

A scammer, pretending to be a UN peacekeeper abroad, emotionally manipulated victims over months and asked for repeated money transfers under false pretenses.

8 Golden Rules to Avoid Financial Scams in 2025

- Verify Identity: If a request seems urgent, even from someone you know – double-check via a separate communication channel.

- Use Official Channels: Never trust links in emails or SMS claiming to be from your bank or tax authority. Type URLs manually.

- Don’t Share Personal Data Easily: Especially bank info, ID numbers, or passwords – even on messaging platforms.

- Research Before Investing: Look up companies in EU investor alert lists or the ESMA database.

- Beware of Unrealistic Returns: If it sounds too good to be true, it likely is.

- Enable Two-Factor Authentication (2FA): For all online banking, exchanges, and email.

- Don’t Trust Pressure Tactics: Scammers create urgency to push victims into hasty decisions.

- Educate the Elderly and Teens: These groups are most vulnerable to phishing and social scams.

How to Spot a Fake Investment Platform

| Feature | Scam Site | Legitimate Site |

|---|---|---|

| Domain Name | Unusual or recently registered | Registered, secure (.eu, .com) |

| Regulation | Claims but no license | Listed in ESMA or national registry |

| Returns Offered | 15-25% monthly with ‘guarantee’ | Realistic, disclosed risks |

| Contact Info | Only email, no address or phone | Full company details |

Tools and Resources to Stay Safe

- ESMA Investor Warning List

- EU Consumer Protection Resources

- Browser plug-ins like ScamAdvisor or Bitdefender TrafficLight

- Whois Domain Lookup (to check domain age and trustworthiness)

Final Thoughts

In 2025, financial scams have evolved, but so can your defense. By staying informed, cautious, and skeptical of unsolicited offers, you can protect yourself from fraud. Whether it is a suspicious investment or a mysterious love interest asking for funds, pause, research, and verify.

FAQ: Avoiding Financial Scams

Scammers are now using AI-powered deepfakes (voice and video impersonations), fake job offers requiring upfront payments, clone crypto investment schemes, business email compromise (BEC), and phishing via messaging apps or QR codes

Scammers use AI to mimic familiar voices or faces in phone/video calls. Don’t trust urgent requests; always verify identity through another channel and use a secret codephrase

In BEC scams, attackers spoof company emails to request fake invoices or wire transfers, causing global losses of $2.9 billion in 2023 alone

Never click unknown links or scan QR codes from unsolicited messages. Confirm sender identity via official websites. Use multi-factor authentication (MFA) to protect accounts

Beware of fake investment schemes, NFTs, or crypto offerings promising high returns, especially if rushed. Always research investment sites, check for regulatory registration, and stick to reputable platforms

Scammers post fake job ads (like LinkedIn), claim you have been hired, then ask for money for training, visas, or equipment. These are always red flags

Immediately stop communication, contact the institution through verified contact info, report suspicious activity, and change passwords or enable MFA. Monitor financial accounts regularly

Follow reliable financial education resources, sign up for scam alerts, and educate yourself through initiatives led by EU supervisory authorities