Managing family finances is more important than ever for households across Europe. With rising living costs, variable energy prices, and economic uncertainty, having a solid family budget is essential. In this comprehensive guide, we offer practical budgeting tips tailored for European families to help you save money, reduce debt, and reach your financial goals.

- Why Budgeting Matters for European Families

- Visual Insight: How Families Spend in Europe

- Step-by-Step Guide to Creating a Family Budget

- European Budgeting Tips by Region

- Tools to Simplify Family Budgeting

- Real Example: Monthly Budget Breakdown (2 Adults + 1 Child)

- Final Thoughts

- FAQ: Creating a Family Budget

Why Budgeting Matters for European Families

Budgeting is more than just tracking income and expenses, also about building financial stability and preparing for the future. Whether you’re living in Paris, Berlin, Madrid, or Warsaw, budgeting gives you control over your money, allowing for smarter choices and less financial stress.

Key benefits of creating a family budget:

- Better savings habits

- Reduced financial anxiety

- Controlled household spending

- Preparedness for emergencies

- Improved long-term planning

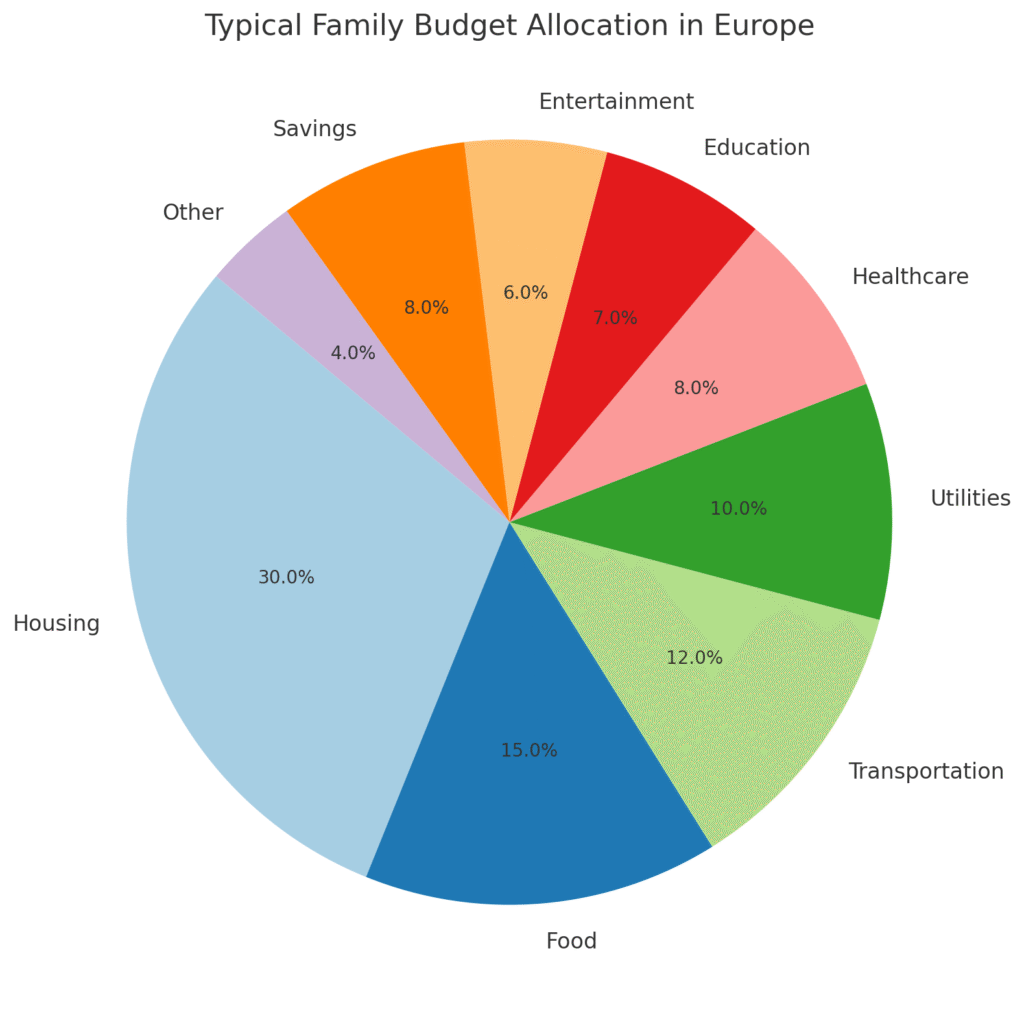

Visual Insight: How Families Spend in Europe

The chart above shows how a typical European household might allocate its budget. Housing often takes the largest share, followed by food, transportation, and utilities. By understanding where your money goes, you can make more strategic decisions.

Step-by-Step Guide to Creating a Family Budget

1. Track Your Income and Expenses

Begin by listing all sources of household income, including salaries, child benefits, and passive income. Then track all expenses—fixed (rent/mortgage, insurance) and variable (groceries, entertainment).

Tip: Use budgeting apps like YNAB, Moneon, or Spendee (popular in Europe) to simplify tracking.

2. Categorize Your Spending

Divide your expenses into categories (see chart). This helps identify areas where you can cut back.

European-specific categories might include:

- Public transport passes (like BahnCard or Navigo)

- School or daycare fees

- Seasonal heating or energy bills

3. Set Spending Limits

Based on your income and past spending habits, set limits for each category. Use the 50/30/20 rule as a baseline:

- 50% Needs (rent, food, utilities)

- 30% Wants (travel, dining out)

- 20% Savings and debt repayment

4. Establish Savings Goals

Whether you’re saving for a family holiday in Italy, a home down payment in Austria, or a child’s education in Sweden, define clear financial goals. Consider setting up automatic transfers to a savings account each month.

5. Adjust for Inflation

With Europe’s inflation rate hovering around 2.2% (as of April 2025), your budget must adapt. Reassess annually and account for rising costs in categories like groceries or energy.

6. Plan for Emergencies

European households are encouraged to have 3–6 months’ worth of expenses saved. This provides a safety net for job loss, medical emergencies, or unexpected repairs.

European Budgeting Tips by Region

- Nordic countries (e.g., Sweden, Denmark): Focus on digital tools; consider budgeting for higher taxes and public services.

- Southern Europe (e.g., Spain, Italy): Account for variable utility costs depending on seasonality.

- Central Europe (e.g., Germany, Poland): Include insurance premiums and transportation passes in the fixed expense category.

Tools to Simplify Family Budgeting

Here are some top budgeting tools used in Europe:

- Revolut and N26 (digital banking with built-in budgeting features)

- Moneon (great for families)

- YNAB (You Need A Budget) for more complex budgeting needs

- Excel templates for DIY budgeting

Real Example: Monthly Budget Breakdown (2 Adults + 1 Child)

| Category | Monthly Budget (EUR) | Notes |

|---|---|---|

| Housing | €1,200 | Rent + utilities |

| Groceries | €450 | Supermarket + fresh produce |

| Transportation | €150 | Public transport pass + fuel |

| Childcare/School | €200 | After-school programs |

| Entertainment | €100 | Dining out, streaming |

| Savings | €300 | Emergency fund + long-term savings |

| Miscellaneous | €100 | Unplanned expenses |

Final Thoughts

Creating a family budget is not just about cutting costs—it’s about living intentionally. For European households, smart budgeting can lead to financial security, peace of mind, and the freedom to enjoy life’s meaningful moments.

Start small, use the right tools, and involve your whole family in the process. Budgeting is not a burden—it’s a roadmap to a better future.

FAQ: Creating a Family Budget

A family budget helps track income and spending, ensuring essential needs are met while allowing savings and avoiding debt

List all income sources and monthly expenses. Categorize spending (housing, food, transport, etc.) and identify areas to adjust

Use comparison tools for energy or internet providers, meal plan to reduce food waste, and cancel unused subscriptions

Yes. Involving partners and older children builds transparency and teaches everyone how to prioritize and manage money

Apps like YNAB, Wally, and Spendee are widely used. Excel or Google Sheets also work well for detailed planning

Base your budget on the lowest expected income. Save extra during high-earning months to cover the shortfall in leaner periods

It means assigning every euro a purpose—income minus expenses equals zero. It ensures every cent is accounted for

Create an emergency fund and regularly set aside money for irregular costs like repairs, medical bills, or seasonal needs